Track Record

Select Transactions

Our Experience

Track Record of defining deals that we have successfully closed on behalf of our clients in the commercial real estate market of South Florida. Iconic properties transacted that defined the local real estate market and panorama of each neighborhood.

Case Studies

Sale & Lease. $55M

FA Commercial sold the retail condos at the base of both towers within the project called Icon. After completing both transactions, FA Commercial leased the retail to Cipriani a fine dining italian restaurant & Cantina La Veinte, a high end Mexican restaurant. Finally, we advised our clients through the sale of the NNN assets

$55M | Icon Brickell

LEASE & SALE. $35M

FA Commercial was selected as the representative to handle the project Brickell Bay Boardwalk consisting over 27,000 sf, by longtime clients Blacklion Investment Group. We assisted clients throughput the first steps of this development project marketing it for sale/lease. In 2020 we closed on the corner retail unit for $8.5M fronting Biscayne Bay for record pricing $1,200 per square foot.

In 2021, FA Commercial leased the entire second floor of 12,000sf to a national tenant called Delilah by H Wood Group from Los Angeles, for a 15 year lease, totaling in over $10M in leasing revenue. Finally FA Commercial is about to close on the final component of the Brickell Boardwalk project to another top hospitality group.

$35M | Brickell Bay Boardwalk

SALE & LEASE. $30.5M

FA commercial has represented both tenants and buyers across multiple transactions in this same office building. By selling the 18th floor again, this marks the 4th full office floor transaction FA Commercial has completed in the same building, after selling floors 18 last year, and the 10th & 11th floor earlier this month! This transaction brings the total historical volume at this same building to $30.5M and a total square feet transacted of 73,725.

$30.5M | 1200 Brickell Office Building

SALE. LEASE. $20M

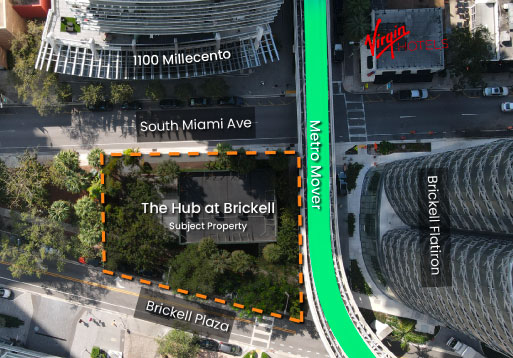

FA Commercial arranged a $6,500,000 deal in the sale of the Brickell Flatiron Sales Center, in which they represented the buyer. Keeping the surrounding Raymond Jungles-designed landscaping, the tenant would demolish the existing building and construct a new standalone location. Situated just two blocks from Brickell City Centre and Mary Brickell Village, The Hub will boast up to 15,000 SF of retail and dining, across 4 floors & a rooftop, becoming the newest hub for local entertainment. The select tenant will be a top tier restaurant group from Los Angeles that will compete against the best restaurants in South Florida.

FA Commercial is curating the leasing in The Hub, and in the well established Brickell Midblock. Notable tenants include LatinCafe2000, Freddo, Akashi, Pura Vida, Empire Social, PilosTacos, Tremble Pilates & Tuluka Gym.

$20M | The Hub at Brickell

SALE. NNN $12.5M

FA Commercial sold the retail properties on South Miami Avenue together better know as Tobacco Road with multiple retail/restaurant tenants, the likes of River Oyster Bar. The assemblage is right in front of The Brickell City Centre, and will be utilized in the future as the next phase of the BCC in a partnership between our client, owner of the property, & Swire group.

$12.5M | Tobacco Road S Miami Ave

SALE. $11.5M

FA Commercial completely sold out the retail condo units at the base of the luxury residential development Park Grove, located in Coconut Grove, right on Bayshore drive facing the bay. FA Commercial represented renown developers Related Group & Terra Group, as well as the buyers which closed on the vacant retail condo of approximately 10,000 sf in size. Separately, FA Commercial also represented the duo of developers in the NNN sale transaction where Tigertail + Mary was the tenant in place. The retail units are surrounded by brand new office towers built for the HQ offices for Related & Terra. Arquitectonica also has their world HQ located just up the street.

$11.5M | Park Grove Coconut Grove

SALE. NNN $9.1M

FA Commercial represented the buyer for a 22,950SF NNN investment property located on 424 N Federal Highway in Fort Lauderdale for $9,050,000 which translates to $394 per square foot. The 1.42-acre site was redeveloped in 2012 and was zoned for commercial use. The current tenant in place is the nationally recognized Fresh Market, which has a long-term lease in place. Fresh market, with more than 175 stores in the United States, brings immense value to the area and to the future residents looking for housing opportunities in the area of Ft. Lauderdale.

$9.1M NNN Fresh Market Fort Lauderdale

SALE. $6.3M

FA Commercial

$6.3M | NNN Retail X Miami

SALE. $5M

FA Commercial closed on the assemblage fronting South Miami avenue corner property, which has a redevelopment potential of over 280 units, said to be the future home of the first Virgin Hotel in Miami.

$5M | 1036 & 1040 S.Miami Ave

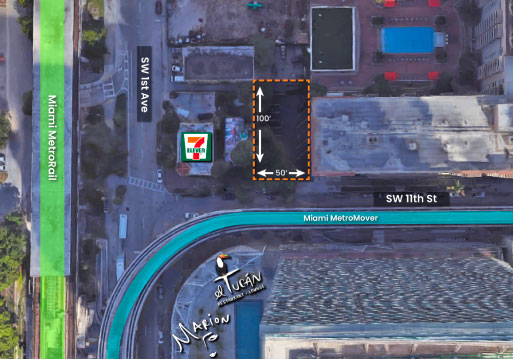

FA Commercial is excited to announce the sale of the property located at 75 SW 11th St. The subject property is situated on a 5,000 sf lot that measures 50 ft by 100 ft. Steps away from major retail centers in the Brickell neighborhood including Mary Brickell Village, Brickell City Center, & Brickell Midblock, perfect to build a freestanding, build-to-suit, retail or restaurant development with potential total leasable area of 19,155 SF (across 8 floor build).

$4.4M | Land Brickell 11th Street

SALE NNN $3.75M

FA Commercial sold a 13,905SF NNN Walgreens located on 630 Blanding Blvd in Orange Park, FL for $3,757,575, which translates to $270 per square foot. The property is located at a hard corner signalized intersection with more than 61,700 Vehicles Per Day. The current tenant in place is the nationally recognized Walgreens, which has recently exercised its first option, showing commitment to the site. Walgreens, with over 9,000 stores in the United States, brings immense value to the area and to the future residents looking for housing opportunities in the Greater Jacksonville area.

$3.75M | NNN Walgreens | Jacksonville FL

SOLD 71,447 SF property that have 3 industrial spaces, located in St Petersburg with great location for a highly qualified tenant. The space is lease to Advance Auto Parts, an automotive aftermarket parts provider, which lease expires in 2024 with 2×5 year options left, and a 5% increase each and to Déjà vu Furniture. This property also holds a Billboard that expires in 2027, and has been there for about 50 years now.

$2.69M | NNN Advance Auto Parts St Pete

Sale & Lease. $48.5M

FA Commercial sold the retail at the base of the 1060 Brickell development between Brickell avenue & South Miami Avenue. The property was traded as a vacant retail asset. FA Commercial also handles the leasing of the property to notable tenants such as Akashi, Latin Cafe2000, Granier Bakery, Bondi Sushi, Coop, Tremble & Champs.

$48.5M | 1060 Brickell

LEASE & SALE. $34.7M

FA Commercial is thrilled to announce the sale of a restaurant/retail space located in the luxury One Ocean residential condo building with 50 units located in the South of Fifth neighborhood. The property pruchased by Black Lion, is surrounded by high-end retail and residential towers, and is just a short walk from the South Pointe Park & the entrance to the beach, with restaurants like Planta, Nikki Beach, Pura Vida, Carbone, Joe’s Stone Crab, Lucky Cat by Gordon Ramsay, Milos, Jia, Intimo, Fogo de Chao, Papi Steak, Prime 112. The space is ideal for restaurant, with a indoor area of 10,404 SF and a outdoor area of 3,588 SF.

$34.7M | One Ocean

SALE & LEASE $30M

FA Commercial advised longtime clients Blacklion Investment Group in the transaction to purchase the retail condo at the base of the luxury residential tower called Marea, which included retail/restaurant tenants, the likes of Red Steakhouse & Kosushi. The retail condo was partly vacant which the previous landlord could not lease up, in just a few weeks FA Commercial was bale to also lease up the property on behalf of Blacklion to notable national tenants in the hospitality industry GAIA, proving once again its expertise in the retail condo and restaurant business class.

$30M | Marea South of 5th

NNN SALE. $16.4M

FA Commercial closed on 12,400 Sq. Ft. retail center on the east entrance of Miracle Mile for $1,280 per Sq. Ft. or $16.4 million. Faerman represented the undisclosed buyer in the transaction. The 1.15-acre site is zoned for T6-8 O, which means it’s a mixed-use lot that can be redeveloped up to eight stories.

Tenants:

JP Morgan Chase and Co., Chipotle, Pei Wei, Toasted Bagel

$16.4M | NNN Chipotle, Pei Wei, Chase

SALE. $12.5M

FA Commercial sold the free standing building fronting collins avenue to a buyer from New York; the building was rented to Charming Charlie and was located on the shopping district of Collins Ave. South Beach Miami, Florida. The property was traded as a NNN asset for a 5% CAP rate.

$12.5M | The Lynmar 735 Collins Ave.

SALE. $10M

FA Commercial represented both buyer & seller of this vacant 53,000sf property which sits on 1 acre of land & had only two tenants at the time of sale.

$10M | 3415 NE 2nd Ave | Edgewater

SALE. $7.65M

FA Commercial sold a 21,700 SF shopping center located on 10640 New East Bay Road in Riverview, FL for $7,650,000, which translates to $353 per square foot. FA Commercial represented the undisclosed buyer in the transaction.

Riverview Plaza is 100 percent leased with national and regional retail tenants including Dollar Tree, Cricket Wireless, Four Stacks Brewery, NY Nails, and Flex Suites Business Center. All tenants are signed to long-term leases and NNN lease structures positioning the buyer with a very stable income stream for many years. Riverview is one of the fastest growing submarkets in the Greater Tampa area with an average household income of $75,784 within a 5-mile radius of the shopping center.

$7.65M | Shopping Center | Riverview

SALE. $5.2M

FA Commercial sold the retail condo at the base of the Brickell House development on Brickell Bay Drive. The property was traded as a NNN asset for a 5% CAP rate with a high end french restaurant called La Petite Maison.

$5.2M | NNN Petite Maison Brickell House

SALE NNN $4.65M

FA Commercial just sold a triple-net (NNN) CVS Pharmacy in South Florida. The 13,038 square foot general retail building was sold for $4,650,000. The Faerman's represented the buyer in the cash transaction.The tenant, CVS Pharmacy, has a history of impressive sales at this location with a NOI of $233,895 and a cap rate of 5.03%. The building is located on a 1.44 acre lot, with 52 parking spaces and has the potential for redevelopment. Entrance to the lot is next to private communities and small office buildings. As a full-service drugstore, this is a strategic investment in the commercial real estate market in the midst of this global health crisis.

$4.65M | NNN CVS Pharmacy | SOFL

SALE. $4.35M

FA Commercial just sold a NNN Walgreens for $4,325,000, roughly $265 per square foot. The Faerman's represented the buyer in the transaction. The property is located in South Florida, on a signalized corner facing a busy street that sees an average of 63,697 vehicles per day. Built in 1998, the 16,320 square foot retail building sits on a 2.3-acre lot, which has potential for future development. The tenant, Walgreens, has a history of impressive sales at this location, with a net operating income of $248,687 and a cap rate of 5.75%. This Walgreens is on a triple-net corporate guaranteed lease with nine years remaining on the base term, and seven five-year renewal options.

$4.35M | NNN Walgreens | South Florida

FA Commercial is pleased to announce the sale of a investment NNN retail property, with a brand new 10-year lease, and a CAP rate of 5.8%. The property is located on a busy road in Tampa.

Fabio & Sebastian Faerman struck a $3,350,000 deal on the sale of this 2,700 SF retail built in 2000 and remodeled in 2022, is occupied by Curaleaf, the world’s largest cannabis company by revenue.

$3.35M | NNN Retail Curaleaf

FA Commercial represented the buyer in the transaction of a NNN Family Dollar free-standing building. The subject property sits on a 1.26-acre parcel with 9,180 rentable square feet, located just 7 miles west of Downtown Orlando and 5 miles north of Universal Studios. An early extension of the lease to Family Dollar was also made, for a fresh new lease of 5 years. The new lease value is $135,000.

$2.2M | NNN Family Dollar

SALE & LEASE $35.8M

FA Commercial has arranged the off market sale of a retail condo in the SLS Lux Brickell, the former home to Katsuya & S Bar representing both buyer Black Lion & seller Related Group.

After procuring the off market deal, FA Commercial assisted Black Lion in the lease transaction to the top tier restaurateur that has multiple restaurants in the South Florida Market, Groot Hospitality. This deal marks their second restaurant in Brickell after much success with Komodo. The new concept will be called Gekko by David Grutman's Groot Hospitality in collaboration with Bad Bunny.

$35.8M | SLS LUX Retail Condo

SALE & LEASE. $31M

FA Commercial sold the retail condo at the base of the Millecento Brickell development on South Miami Avenue. The property was traded as a vacant retail asset. FA Commercial also handles the leasing of the property to notable tenants such as Freddo, Pura Vida, Prime Cigar, Tuluka Gym, Wet Miami & Pilo's Tacos.

$31M | Millecento Brickell

SALE. $25M

FA Commercial sold the land in this transaction to Property Markets Group for a 166 unit development of the luxury Echo Brickell; a skyscraper in the Brickell district of Downtown Miami, Florida. PMG developed a 57 story and 657 foot tall tower with a unique curved shaped.

$25M | Echo Brickell

FA Commercial is excited to announce the sale of the property located at 2020 Ponce is located strategically in the heart of the Coral Gables business district, a center of commerce and dining and finance for the U.S. and Latin America. The building is located steps away from Alhambra Circle, Miracle Mile, and the Giralda Plaza Streetscape, as well as minutes from the Village of Merrick Park.

$14M | Coral Gables Office Bldg

SALE. $12.1M

FA Commercial has successfully arranged the sale of the trophy waterfront restaurant building, Amara at Paraiso, representing both buyer Black Lion & sellers Alta Developers/Related Group. Amara at Paraiso is a concept by Chef Michael Schwartz which is well known for his Michelin guide Bib Gourmand restaurant Michael's Genuine in Miami Design District.

$12.1M | Amara at Paraiso

FA Commercial is pleased to announce the sale of this off market deal in Wynwood North, representing both buyer and seller. The subject property is situated on a 41,025 SF lot zoned for residential uses, with the possibility of building 140 units Multifamily building or a Hotel of 236 lodging units.

$9.8M | Development Land | Wynwood

FA Commercial helped its clients from the original purchase of this site for $2.7M to today’s final transaction selling the site for $7M with potential development. The 19,850 SF lot is strategically located just a few blocks away from the new Brickell City Centre, SLS Hotel, Echo Brickell, Mary Brickell Village, and Brickell Bay Boardwalk.

$7M | Brickell Development Land

SALE. $5.2M

FA Commercial sold an 88,426 SF development site in Pinecrest, Florida. The land was sold for $5,200,000. FA Commercial represented both sides in the transaction.

The Villas at Pinecrest is a multifamily project that will feature 18 luxurious townhouses. The project has an average gross unit size of 3,588 SF, and the units will be distributed over 4 buildings. Unit amenities include impact-resistant windows and doors, bathroom cabanas with retractable roof, and 2-car garages with remote-controlled garage doors..

$5.2M | Pinecrest Development Site

FA Commercial is pleased to announce that Fabio Faerman and Sebastian Faerman successfully struck an Off Market deal of $4.4M in the sale of a development land located in Edgewater.

This 13,800 square foot land is nearby the Shops at Midtown, Miami Design District, & Edgewater. The subject property is surrounded by thousands of residential units and hundreds of thousands of retail & office square footage.

$4.4M | Development Land Edgewater

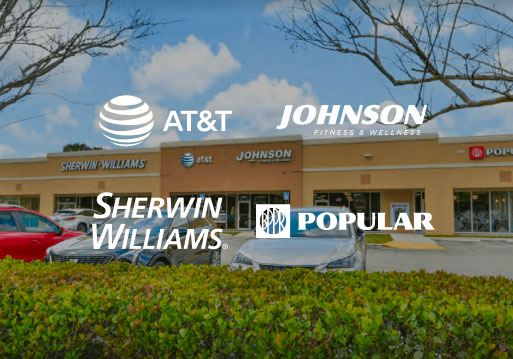

FA Commercial represents the buyer in this $4M transaction of a NNN retail strip center, Shoppes Sunrise, located in densely populated Sunrise, FL. The investment property has a CAP Rate of 6% with 4 tenants: Sherwin Williams, At&t, Johnson, and Popular. The subject property sits on a 43,675 SF parcel with 9,490 rentable square feet, 100% Occupancy with all National Credit tenants with a long-term newly signed leases.

$4M | NNN Sunrise Shoppes

FA Commercial is pleased to announce the sale of a 2,000 SF NNN retail investment property, with a Long Term, NNN Lease in place to Dunkin Donuts in Orange Park

Fabio & Sebastián Faerman successfully struck a $2.6M deal selling a NNN retail investment property with an in place CAP Rate of 4.7%, located at 1408 Park Avenue, Orange Park, FL 32073.